In a historic capital market transaction, the Tanga Urban Water Supply and Sanitation Authority (Tanga UWASA) today issued a 10-year water infrastructure green revenue bond valued at TZS 53.12 billion. This is the first-ever Subnational Water Green Bond in the history of Tanzania and East Africa.

The goal of the Tanga water bond issue is to raise funds for Tanga UWASA, an independent subnational public organization, to expand and improve current infrastructure projects that will enhance the city of Tanga’s water supply and sanitation services, as well as those of neighboring townships.

The Vice President of the United Republic of Tanzania, Honorable Dr. Philip Isdor Mpango, expressed gratitude to UNCDF “for their technical and financial support and coordination role through the entire bond issuance process.”

“By demonstrating its capacity to develop local and national capacities through alternative finance tools, UNCDF is spearheading this revolutionary path. By introducing novel financial instruments like revenue bonds and thematic bonds, which comprise social, blue, and green bonds, we are able to finance projects beyond development and infrastructure. Rather, we are establishing a worldwide standard for sustainable investment instruments,” stated Mr. Zlatan Milisic, Tanzania’s UN Resident Coordinator.

“This novel agreement impacts public institutions and establishes a strong framework for demonstrating to institutions and local government authorities how to obtain funding for self-sustaining projects via the capital markets,” said Nicodemus Mkama, CEO of the Capital Markets and Securities Authority.

The Tanga Water infrastructure Green Bond is a national alternative financing mechanism template that can be used to finance transformative development activities and help achieve national development goals. Peter Malika, Chief Technical Advisor for UNCDF in Tanzania, congratulates the Tanzanian government for accomplishing this significant milestone. The National Municipal Taskforce, which was made up of representatives from Zanzibar, the Dar es Salaam Stock Exchange, the Bank of Tanzania, the Ministry of Finance, the Ministry of Water, the Ministry of Local Government (PO-RALG), and the Capital Market and Securities Authority (CMSA), is acknowledged and appreciated for its assistance, cooperation, and insightful advice.

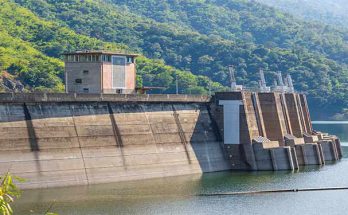

The bond’s financing would enable the increase in water production, treatment, and distribution capacity from 45,000 to 60,000 cubic meters per day. This is expected to improve the availability of clean, safe water for about 6,000 additional households, or slightly over 26,000 people. The money raised from the sale of the green element will go toward supporting environmental preservation initiatives and safeguarding the Zigi River’s and the nearby villages’ natural water supplies.

Both domestic and foreign subscribers may now purchase the Tanga water bond as of today’s issuance and prospectus publishing. In about two to three months, the Tanga water bond will be listed on the Dar es Salaam stock exchange.

For the governments of Tanzania and many other countries in Sub-Saharan Africa, this transaction is significant because it provides a replicable model for how local governments and subnational organizations can access domestic capital markets to finance development projects and income-generating local initiatives in local currency. This strategy lessens the pressure on governments to lower their national debt ceilings because it does not call for the deployment of sovereign guarantees.

In comparison to national governments and the private sector, local and subnational authorities have historically encountered considerable obstacles when attempting to access capital markets. A rated third-party guarantee facilities and other innovative financial instruments, such as green bonds, employ suitable governance structures to lower investment risks, and they have become an effective means of assisting local and subnational governments in raising funds to carry out sustainable national development priorities. Leading the Malaga Coalition for a financial environment that benefits cities and local governments is UN Capital Development Fund in collaboration with United Cities and Local Governments. One excellent illustration of the kind of systemic and scalable reform that the Coalition is pushing is the Tanga Bond.

The Dar es Salaam Stock Exchange’s Green Bond Listing Rules, the International Capital Markets Association’s (ICMA) Green Bond Principles 2021 (“GBP”), the government’s Alternative Project Financing strategy (APF), and the Five-Year Development Plan, which ends in 2026, are all in line with the bond’s international standards, which is why the central government of Tanzania has expressed its support for it.

The highest level of Tanzanian government commitment to achieving this goal, including directives from President Samia Suluhu Hassan of the United Republic of Tanzania and particular clearances from important government ministries and national institutions, contributed to the transaction’s success. One such is the National Municipal Task Force. with participation from important organizations like the central bank, capital markets regulator, treasury registrar, and Dar es Salaam Stock Exchange, and chaired by the Ministries of Finance and Local Governments.

All regulatory agencies, including the Ministry of Water, the Ministry of Finance, and the Capital Market and Securities Authority (CMSA), have approved the Tanga water bond.

As Tanga UWASA’s principal technical and financial partner in the deal, the UN Capital Development Fund (UNCDF) was important. Through its distinct investment mandate, UNCDF provides its government partners with capital deployment in the form of concessional and commercial funding, guarantee facilities, technical expertise, policy impact, capacity building, sensitization, awareness, and investment consultancy. It serves as an example of its ability to assist governments in raising funds locally to finance sustainable development in accordance with their national agendas and international commitments, including Africa 2043, Agenda 2023, the SDGs, the Addis Ababa Action Agenda, and the Paris Agreement.