Rwanda’s goal of achieving middle-income status by 2020 is proving elusive, but efforts to increase economic competitiveness are paying off, as its minister of trade and industry explains to African Business.

Rwanda’s goal of achieving middle-income status by 2020 is proving elusive, but efforts to increase economic competitiveness are paying off, as its minister of trade and industry explains to African Business.

For a small, landlocked country in East Africa lacking in natural resources and competitive industries, Rwanda has long been punching above its weight, with average growth of 7.9% per year between 1995 and 2014, according to government figures.

Established in 2000, the government’s Rwanda Vision 2020 policy document includes provisions to nurture the private sector, build infrastructure and boost the knowledge economy.

Progress has been made, but the country remains poor – at $710 per capital its gross national income still falls well short of qualifying for the middle-income status the country sought to acquire by 2020.

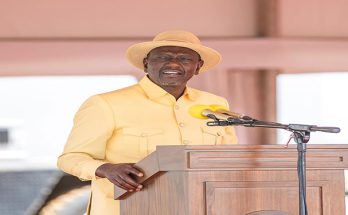

The trade and industry country’s minister, Soraya Hakuziyaremye, spoke to African Business about how the country is focusing efforts on building a vigorous export sector to bid a trade deficit, diversify the economy and sustain its growth momentum.

Last year the Rwandan economy grew at 7.2%, according to the IMF, backed by strong performances in sectors including trade and manufacturing.

Both have benefited from the country’s Made In Rwanda policy, implemented in 2015 to enhance industrialization, A key goal of the strategy is to boost the capacity to produce internationally competitive products by adding value to traditional goods and creating new value chains for others.

The government initially targeted the textile, garment and leather sub-sectors but now includes value chains like agro-processing, horticulture and construction materials.

The aim is to ramp up exports by investing in and enabling local manufacturing, which in turn is intended to balance the import bill of a small country lacking in natural resources.

Last year, in an effort to create favorable market conditions for local producers, the government hiked tariffs on imports of used US clothing and footwear.

In retribution, Washington suspended the duty-free access to the US market enjoyed by Rwandan textile manufacturers under the African Growth and Opportunity Act (AGOA).

While Hakuziyaremye attempts to downplay the disagreement, she also reveals that local manufacturers are being encouraged to seek new markets in a bid to mitigate the blow.

“We have two local textile manufacturers, and they’ve both been able to find other markets in Europe to sell to,” she says.

Rwanda’s tariffs remain in place, and the refusal to budge reflects the government’s commitment to the Made in Rwanda policy, despite Washington’s evident disapproval and the threat it poses to other Rwandan exporters that have made inroads into the US.

The country’s overall trade deficit has decreased by 36% as exports climbed to $944m in 2017, up from $559m two years prior since Made in Rwanda launch

The government hopes to further encourage this trend by working closely with export-focused companies and offering attractive incentives for international and local firms looking to do business.

“We are providing financial assistance through an export facility to support our exporters,” says Hakuziyaremye. “They can conduct market studies [and] receive financial support and subsidized rates on imports, which has really helped to increase the country’s exports.”

Through a joint partnership with the government Africa upgraded their Food sector, a consumer goods company entering Rwanda in 2016, which has begun to produce and export nutritious foodstuffs to the surrounding East African region.

Along with new and improved products, Rwanda’s portfolio of global trading partners is swelling.France has recently upped its commitment to Rwanda, following the thawing of diplomatic relations that had been frosty for many years.

French support was important in securing the election of Rwanda’s minister of foreign affairs and cooperation, Louise Mushikiwabo, as secretary general of the Organisation International de la Francophonie, the international organisation that brings together French-speaking countries.

Hakuziyaremye says that exports to France have risen in goods ranging from tea and coffee to niobium, a rare metal used in items such as piping, airplane parts and MRI machines.

Niobium is traditionally exported to China and the US, but promising new markets include Thailand, Germany, Spain and France, Rwanda’s first tantalum and niobium factory which is an international mining processing firm Power Resources Group began building in 2017 at an estimated cost of $16m.

Another developing partner is the United Arab Emirates (UAE), Penning an opinion piece in The New Times daily newspaper in March 2018, Sheikh Abdullah bin Zayed, the UAE’s minister of foreign affairs wrote:

“Looking forward, the UAE sees great potential to further strengthen its cooperation with Rwanda by continuing to make progress over a range of economic and investment areas, including agriculture, education, infrastructure, and tourism.”

According to Zayed, between 2014 and 2016, non-oil bilateral trade rose from $30m to $200m, With the recent signing of bilateral agreements protecting investments and avoiding double taxation this figure is expected to grow.

Rising to $87m in 2016 from just $40m the year before Rwanda’s exports to the UAE doubled just in a year, according to the United Nations Comrade database. Pearls, precious stones, metals and coins made up 92% of these exports.