A significant USD$7.4 million securitized financing facility was completed, according to a statement released by Chapel Hill Denham, the biggest alternative asset manager in Nigeria and d.light, the global provider of transformative household products and affordable finance for low-income households.

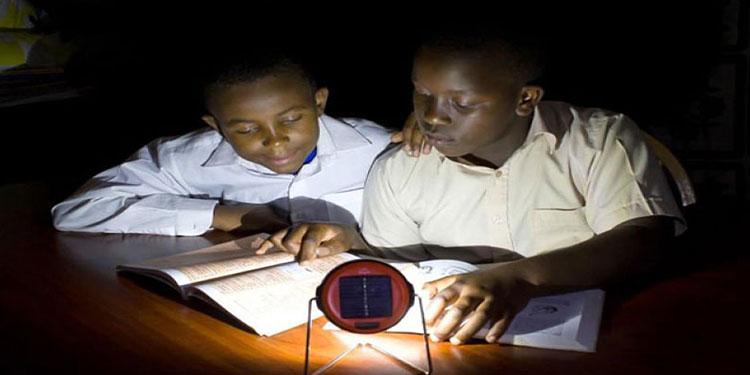

The Nigeria Infrastructure Debt Fund of Chapel Hill Denham will supply the additional funding, which will be utilised to expand d.light’s low-cost Pay-Go line of reasonably priced solar-powered goods aimed at lower-class consumers.

African Frontier Capital, which serves as both the transaction’s master servicer and backup servicer, established and sponsors the financing arrangement.

“This historic financing opens up access to our range of solar-powered household goods to more low-income families and households in Nigeria, in a way that is affordable for them and sustainable for our business,” d.light CEO Nick Imudia said in a statement regarding the development.

“Securitized finance is a flexible and scalable financing mechanism that d.light has successfully used in other Sub-Saharan African nations to raise equity for off-grid solar systems. The financing model is secured against both current and future client sales. As we expand our activities in Nigeria, we are currently putting this experience to use there. We have a partner in Chapel Hill Denham who is equally committed to sustainable development as they are to business.”

“This transaction signifies a pivotal stride in sustainable infrastructure investment in Nigeria, setting a transformative precedent for the renewable energy sector,” said Bolaji Balogun, the CEO of Chapel Hill Denham, in response to the transaction. Chapel Hill Denham is igniting innovation in the renewable energy sector, advancing sustainable development, empowering communities, and reshaping Nigeria’s infrastructure landscape for a brighter, more sustainable future for all by leading the way in local currency securitization for the financing of solar home systems and household utilities in Nigeria.”

“With the first-ever at scale, local currency securitization financing for Solar Home Systems and other solar-powered household goods in Nigeria, this is another significant milestone for Chapel Hill Denham and NIDF,” says Anshul Rai, partner for infrastructure and climate at Chapel Hill Denham. “With a focus on addressing Nigeria’s biggest sustainable development concerns, we are expanding the array of financing options accessible to infrastructure providers in the country.”

Nigeria has the largest economy and the largest population in Africa. According to the International Renewable Energy Agency, International Energy Agency, United Nations, and World Bank, Nigeria has approximately 86 million people living without access to electricity, making it the nation with the highest number of people without electricity in the previous year’s Energy Progress Report. Seldom do people who are linked to the grid get a consistent supply.

Furthermore, GHG-emitting thermal generation sources now supply around 80% of Nigeria’s electricity, making a swift switch to clean and dependable energy sources necessary. Chapel Hill Denham and d.light are dedicated to assisting this energy shift by providing cutting-edge goods and funding options.