GCL Energy Investment, a subsidiary of GCL Group (Golden Concord Group), a leading Chinese integrated energy service provider that specializes in clean energy and new energy with diversified development of related industries, and UAE Hodler Investments, a UAE-based investment company with its headquarters in Dubai that includes in its portfolio energy, AI, and digital asset mining startups like PermianChain, Brox Equity, NEXGEN, and others, have partnered to develop a distributed energy infrastructure project to power next generation distributed compute cluster data centers that are hosting AI, Blockchain, and other applications.

GCL Energy Investment, a subsidiary of GCL Group (Golden Concord Group), a leading Chinese integrated energy service provider that specializes in clean energy and new energy with diversified development of related industries, and UAE Hodler Investments, a UAE-based investment company with its headquarters in Dubai that includes in its portfolio energy, AI, and digital asset mining startups like PermianChain, Brox Equity, NEXGEN, and others, have partnered to develop a distributed energy infrastructure project to power next generation distributed compute cluster data centers that are hosting AI, Blockchain, and other applications.

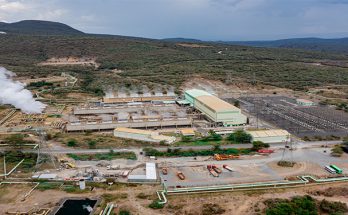

The Memorandum of Understanding indicates that Hodler Investments and Golden Concord Group would co-invest in viable and appropriate energy projects that use sustainable energy-efficient technologies and energy optimization. In order for Ethiopia to welcome international data center operators and lower carbon emissions, Golden Concord Group will provide vital energy infrastructure that will monetize underutilized energy in Ghana.

As Ethiopia emerges as a top Bitcoin mining destination, an agreement was inked earlier in 2024 to build data mining and artificial intelligence infrastructure. This aligns with the “Digital Transformation Strategy 2025” of Ethiopia. The Ethiopian datacenter industry is projected to grow from its 2022 valuation of $95 million to $226 million by 2028.

About 90% of Ethiopia’s 5,200 MW of installed generating capacity comes from hydropower, with the remaining 10% coming from thermal and wind sources. The size of the Ethiopian datacenter market was estimated at USD 95 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 15.54% to reach USD 226 million by 2028.

Managing Director of HOLDER INVESTMENTS Mohamed El Masri said, “Our strategic partnership with GCL Group will accelerate our mission to build distributed energy infrastructure to power compute clusters that optimize wasted energy resources regionally.” In addition to providing fair energy infrastructure, it will bolster Africa’s position in incorporating data mining systems that underpin an independent digital economy.

GCL Energy Investment’s CEO, WANG Dong, stated, “Our collaboration with HOLDER INVESTMENTS seeks to address a number of issues confronting Ethiopia’s energy industry. We think that the funding gap for renewable energy may be filled and decarbonization accelerated by combining smart capital with current technologies.

The announcement of HODLER INVESTMENTS’ ongoing preparations for a $500 million Digital Energy Infrastructure (DEI) Fund, in which UAE-based GEWAN holdings would participate, follows the strategic cooperation with GCL Energy. The DEI will be created as a closed-ended fund, contingent to regulatory and compliance clearances. Offtake partners looking for energy and connection for artificial intelligence and digital asset mining activities, as well as soft commitments from lead investors and in-kind donations, have already committed to the DEI Fund.