Latest News

View All

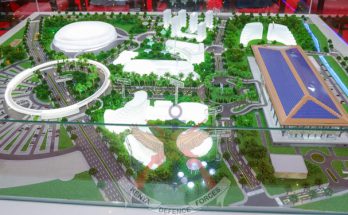

Construction of Ksh31.5 Billion Bomas International Conference Centre Underway

The construction of the Bomas International Conference Centre (BICC), a landmark project valued at Ksh31.5 billion, is progressing under the supervision of the Kenya Defence Forces (KDF) through the Ministry …

Building and construction

View All

Tanzanian President Samia is decorated by the AU and Global Water Partnership

The Global Water Partnership, in partnership with the African Union, has presented President Samia Suluhu Hassan with the Presidential Global Water Changemakers Award 2025, the highest honor in water. Tanzania’s …

Automotive news

View All

Tanzania and Zimbabwe Make It Easier To Import Cars from Dar es Salaam

TANZANIA has opened an office for the Tanzania Ports of Authority (TPA) in Zimbabwe which will aid the importation of vehicles and different products from the sea connected country. Until …