NMB Bank Plc has posted another industry record breaking performance after registering a 41% increase in profit before tax that jumped to 420 billion in the year ended 2021, compared to 301 billion of the preceding year.

NMB Bank Plc has posted another industry record breaking performance after registering a 41% increase in profit before tax that jumped to 420 billion in the year ended 2021, compared to 301 billion of the preceding year.

In the period under review, the largest lender in the land posted a profit after tax of 289 billion which consolidated its market leadership and top profitability position in the industry.

This is 39% higher than the industry record of 210 billion registered in the year ended 2020.

The outstanding performance is attributed to the bank’s differentiated business model and disciplined execution of its strategic initiatives that continue to drive market share gains and further cement the bank’s leading position within the market.

Speaking during the release of the bank’s full year results, the NMB Chief Executive Officer, Ms Ruth Zaipuna said, “I am profoundly proud and humbled by what we have achieved as a team, and I remain ever so confident that with the disciplined execution of our strategy, increased customers’ activities, high staff morale and strong leadership, we will sustain this strong growth momentum of our underlying business,”

According to Ruth Zaipuna, the bank’s strong business growth and solid financial performance are critical in supporting its mission of leading Tanzania’s social and economic development agenda.

“Our focus and contribution in the agriculture sector continued during the year, whereby we were the 1st bank to set aside a special agriculture fund (100 billion) for lending in the agriculture value chain at interest rates not exceeding 10%,” Ruth Zaipuna said.

She added, “We have continued to heavily invest in various social impact programmes by setting aside 1% of the bank’s profit after tax, every year. In 2021, we spent over 2 billion towards various social impact initiatives in Education, Health, Financial Literacy and Environment,”

The strong growth in profitability is on the back of solid operating income growth of 18% year on year both from net-interest income growth of 19% due to increase in loans and advances as well as an increase in non-funded income by 15% year on year, reflecting increased customer activities on the bank’s channels.

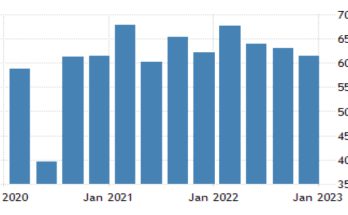

The bank has also continued to demonstrate laudable operational efficiency, with further improved cost-to-income ratio to 47% from 51% in the same period last year, being well within the regulatory threshold of 55%.

The bank maintains a strong balance sheet with sustained growth demonstrating enhanced customer relationships in core business segments.

Loans and Advances increased by 13% year on year to 4.6tri/- (net of impairment) owing to commendable credit portfolio growth in key market segments, including Agri-business, SME, and Personal Loans.

The total deposits grew by 25% year on year to 6.4tri/-at the end of December last year compared to 5.3tri/- in December 2020.

The bank’s total assets closed at 8.7tri/-, up 23% year on year from 7tri/- in the same period last year.